Max refund is guaranteed and 100 accurate. Iowa Property Tax Apply.

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028.

. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Adopted and Filed Rules. Scroll down to the Homestead Tax Credit section and click on the link that states.

Property Tax Exemption Application. Equals the Net Taxable Value divided by 1000 multiplied by the Tax Levy Rate and rounded to the nearest cent. This handy calculator helps you avoid tedious.

Fast Easy Secure. File a W-2 or 1099. Smaller parcels may qualify in they are contiguous to a qualifying parcel and under the same ownership.

In 2021 the Iowa legislature passed SF 619. New applications for homestead tax credit are to be filed with the assessor on or. What is a Homestead Tax Credit.

Learn About Property Tax. Equals 100 Actual Value multiplied by the appropriate Rollback Rate. What is the Credit.

The property owner must be a resident of Iowa pay Iowa income tax and occupy the property on July 1 and for at least six months of every year. The homestead credit is calculated by dividing the homestead credit value by. How much is the homestead tax credit in Iowa.

Law. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the disabled veteran tax credit and clarifies the eligibility of a person who has received multiple discharges from service for the disabled veteran tax credit. Persons in the military or nursing homes who do not occupy the.

8011 Application for credit. No homestead tax credit shall be allowed unless the first application for homestead tax credit is signed by the owner of the property or the owners qualified designee and filed with the city or county assessor on or before July 1 of the current assessment year. This benefit reduces a veterans assessed home value for property tax purposes by 1852.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. How do I estimate the net tax for a residential property with Homestead and Military Tax Credit. To submit the application electronically click on the Submit Application.

Property owners must sign with the City or County Assessor and qualify under standards set by the State of Iowa. Ad All Major Tax Situations Are Supported for Free. Ad Register and subscribe 30 day free trial to work on your state specific tax forms online.

Discover Helpful Information And Resources On Taxes From AARP. Know the basics when it comes to capital gains tax. In order to qualify a service member must have served on active duty during a period of war or for a minimum of 18 months during peacetime.

For additional information and for a copy of the application please go to the Iowa Department of Revenue web site. 701801425 Homestead tax credit. In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the.

This credit reduces the value on which taxes are calculated by a maximum of 4850. The homestead credit is a tax credit funded by the state of iowa for qualifying homeowners and is based on the first 4850 of net taxable value. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. Apply online for the Iowa Homestead Tax Credit. Click on the Save button at the top left of the screen.

The Military Tax Credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or Iowa National Guard who served at least 20 years qualify for this. Learn About Sales. Start Your Tax Return Today.

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and. This exemption is a reduction of the taxable value of their property amounting to a maximum. The current credit is equal to the actual tax levy on the first 4850 of actual value.

Parcels with an Agricultural Class of at least 10 acres in size qualify for the Ag Land Credit. Disabled Veterans Homestead Tax Credit. For properties located within city limits the maximum size is 12 acre where the home and the buildings if any are located.

Tax Credits. Fill out the application. January 8 2021 356 PM.

In other words claimants aged 70 years or older with higher household income are able to qualify for the property tax credit in 2022 and. Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on household income for claimants aged 70 years or older.

Free means free and IRS e-file is included. New applications for homestead tax credit are to be filed with the Assessor on or before July 1 of the year the credit is first claimed. Find the capital gains tax rate for each state in 2020 and 2021.

For most taxpayers the Homestead Credit equals 4850 divided by 1000 multiplied by the Tax Levy Rate multiplied by 77. Once you have this information you can work out a capital gains tax calculator to give yourself a good idea of what your capital gains tax. Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa for income tax purposes and occupy the property for at least six months each year.

Edit Fill eSign PDF Documents Online. Once a person qualifies the credit continues until the property is sold or until the owner no longer qualifies.

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How Can The Disability Tax Credits Help Autistic Children In Canada

Find Out What Your Cibc Aeroplan Card Gets You Cibc

Debt Payoff Letter From Wells Fargo Bank

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

7th Level Open House Chart Open House Top Real Estate Agents House

Is Life Insurance Taxable Forbes Advisor

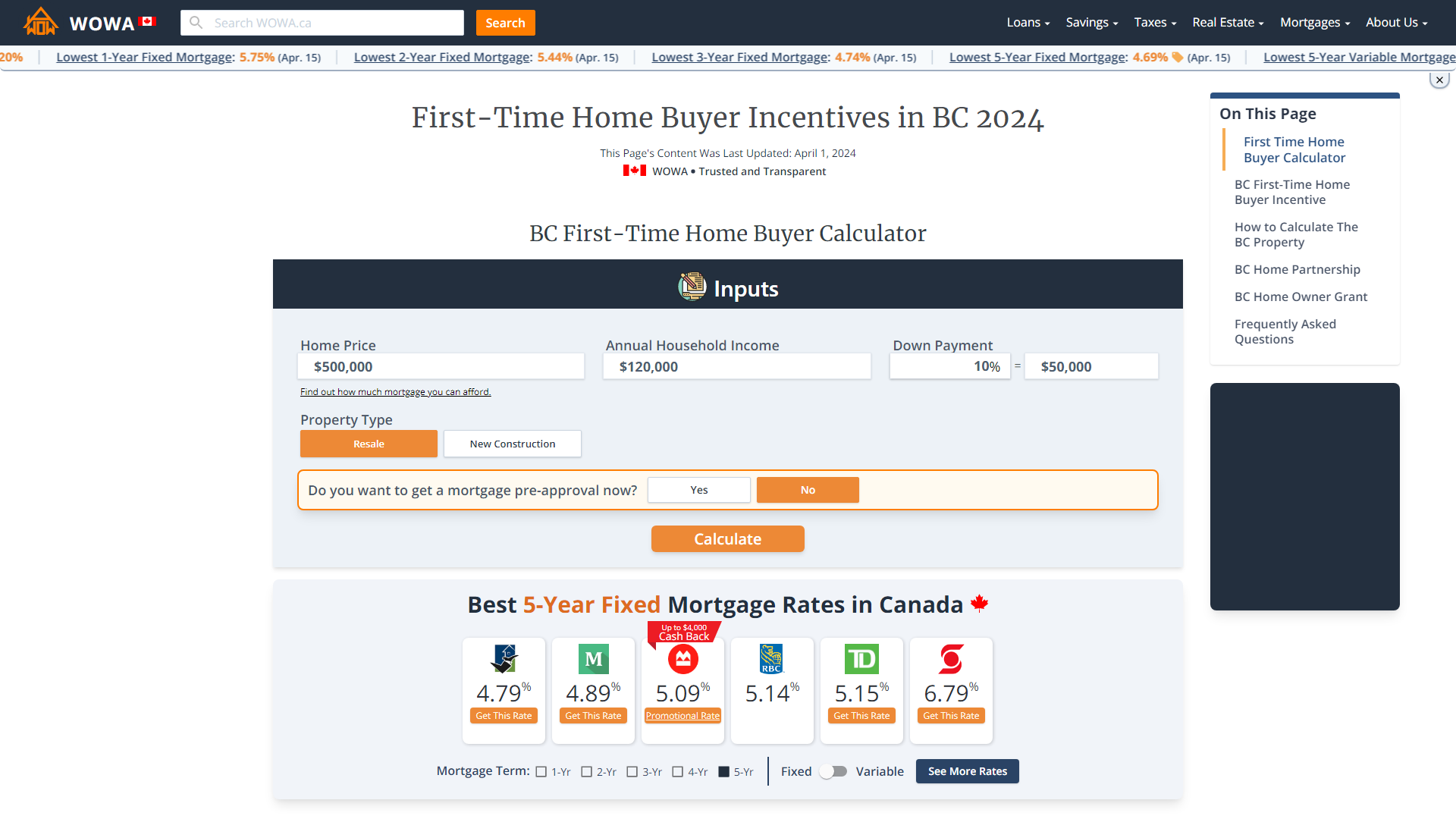

Bc First Time Home Buyer Incentives Wowa Ca

What Is A Homestead Exemption And How Does It Work Lendingtree

How Can You Qualify For Disability Tax Credits For Adhd Parental Guide

How Can The Disability Tax Credits Help Autistic Children In Canada

Why You Should Be Careful With Life Insurance Policy Loans Forbes Advisor

Calculating Property Taxes Iowa Tax And Tags

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Financial Advisors Property Tax